If you are anything like I was, you too suffer from spending impulsively from time to time. And this bad habit was the reason why I could never achieve the financial goals I set for myself. Back in 2010, I was able to overcome impulsive spending using the following five actions:

Action #1. Unsubscribe From Retailer’s Email Lists

Not only are the constant emails from your favorite stores and boutiques distracting, they also tempt you to take unplanned shopping trips. Go ahead and click on the unsubscribe button at the bottom of those emails (or mark as junk mail). You will stop the cycle of being persuaded by their latest marketing campaigns.

Action #2. Check Your Monthly Budget Before Shopping

Before you head out to the mall or boutiques, refer back to your budget you created in The Ultimate Financial Planner to remind yourself how much cash you allotted to shopping.

Action #3. Pay with Cash

After you have determined the amount you are spending during your shopping trip, stop by the ATM and withdraw the amount in cash.

Using cash and leaving your debit card tucked away will deter you from overspending because most of your money is “inaccessible” to you. This technique helps you stick to your spending plan and forces you to choose which pieces of clothing you are going to purchase versus purchasing all of them.

Action #4. Give Yourself Time to Decide on Items You Want To Purchase

When you find items you would like to purchase, browse the store while holding onto them for 5-10 minutes. This technique will allow time to ponder and decide if you really want or need the items.

When online shopping, add the items that you want in the shopping cart and leave it there a few days. Again, this gives you time to check in with your emotions and decide if a larger purchase is a wise purchase.

Do not use shopping as a stress-relieving method. When you are in an emotional state, your judgment is poor and you are more likely to spend impulsively.

Action #5. Identify and Eliminate Spending Triggers

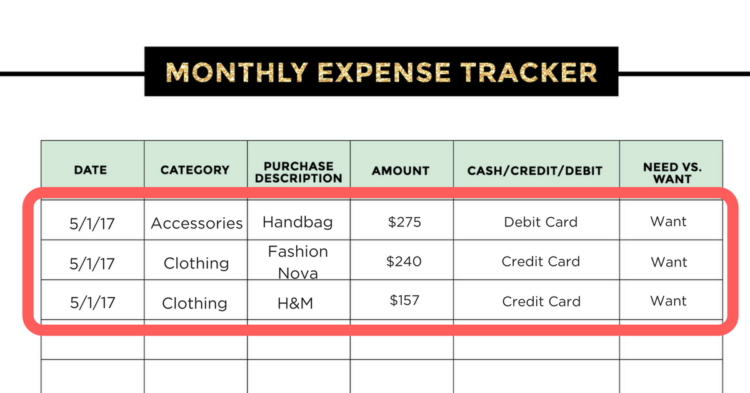

Use the Monthly Expense Tracker template from The Ultimate Financial Planner to record and analyze your spending habits each month. It will help you identify where, when, and how you spend money on a daily basis so you see your spending triggers and eliminate them.

Now, I want to hear from you…

Question: What steps do you take to avoid spending impulsively? Leave your response in the comment section below.

Sulan

November 23, 2015 at 08:07 (10 years ago)Great article

Tara J.

November 25, 2015 at 20:26 (10 years ago)Thank you Sulan for reading and sharing feedback! 🙂