IT’S TIME TO TAKE CONTROL OF YOUR MONEY! LET’S BUDGET.

Creating a monthly budget was hands down the most important step for me in becoming and remaining financially stable (read how after you finish your budgeting below). It allows me to effectively manage the income I received each month by allocating 100% of it to that month’s expenses and financial goals before I even had the chance to blow it!

So, don’t wait until the beginning of a month or week to start your zero-based budget. Do it now. It is simple and after a few months, you will be budgeting like a financial guru!

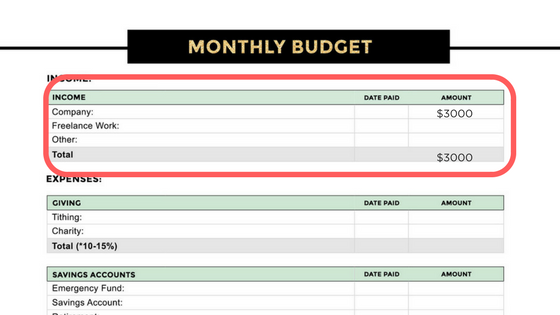

Step 1: Estimate your monthly income at the beginning of each month.

If your income fluctuates month to month, calculate an average take-home pay based on the previous three months’ earnings. The estimate should come pretty close.

When calculating your monthly income, be sure to include ALL sources of income including take-home pay from your job/side business, child support, monetary gifts, garage sale earnings, etc.

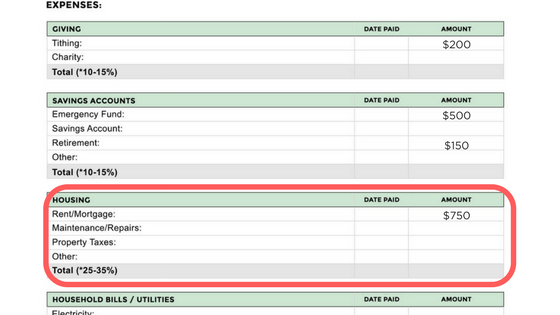

Step 2: Calculate your monthly expenses.

Take a moment to write out all the bills and expenses you have to pay during the upcoming month. Prioritize your payments and add in expenses in order of importance. Be sure to include money for groceries and irregular expenses like your yearly renter’s insurance payment or license plate renewal.

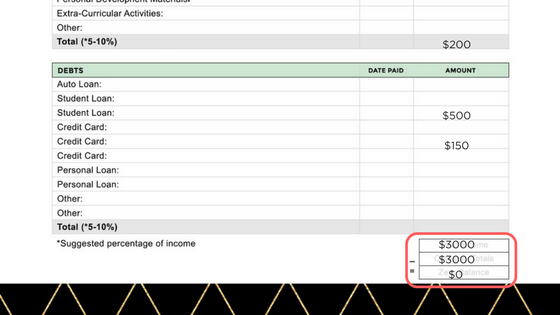

Step 3: Zero Out Your Budget

Your income minus your expenses should equal zero, hence it being called a zero-based budget. When you get the difference between your income and expenses to zero, it means that you have given every dollar you have coming in a job. This is key because it stops you from blowing money on unnecessary stuff throughout the month.

If you have a positive number, allocate that money into another category like your emergency fund savings. In the event you have a negative number, remove some money from a category or two until it is at zero.

Step 4: Check In With Your Budget Weekly

Once you start the budget, you’ll still need to stay on top of your expenses. The good news is that The Ultimate Financial Planner makes tracking your expenses (and budgeting for them) extremely easy. Click here to learn more!

Question: Do you budget monthly? How has it helped in you maintaining control of your money? Leave your response in the comment section below.

All the Best,

Jacqueline

October 17, 2021 at 23:08 (3 years ago)I have been seriously budgeting monthly for about a year, I did some yearly personal challenges such as the Ones & The Envelop, which has allowed me to save a little extra money, now it’s time to count it out and disburse, but I find myself having anxiety on letting it go and deciding best way to spend it. Is this something you see with new savers?